A Government Program that has successfully taken people out of poverty and provided financial security to millions of Americans for over 85 years

Social Security

What you need to know to maximize your benefits

When it comes to your retirement, Social Security is something which you can’t overlook. The program was designed to provide only about 40% of income during retirement, but currently it is the only source of income for 40% of retirees. Yet, 95% of retirees will end up leaving money on the table because they choose to take their Social Security at the wrong time.

Details of the Program

- Dated Started:1935

- Number of People Receiving Benefits: 64,000,000+

- Cost of the Program: 1 Trillion+ Annually

- Benefits of the Program: Guaranteed Lifetime Income

Who is receiving Social Security Benefits?

Retired Workers

Spouses/Ex-Spouses

Parents

Widow(er)s

Children

Disabled Workers

‘When to take Social Security’ seems to be the question that everyone wants answered, but the answer for your neighbor might not be the same as it is for you.

Individual facts and circumstances can make a big difference when it comes to figuring out when you should start taking your Social Security benefits. Some of the main things that you should consider before you apply for benefits are your health, your wealth, family members who might benefit from your work record, and the risks facing your retirement.

What is the average life expectancy?

- 78 if you include infant deaths and accidents

- 84 for a male who reaches age 65

- 88 for a female who reaches age 65

- 25% chance of living to age 90

- 10% chance of living to age 100

Join us for more on Social Security!

A secure retirement is built on a foundation of wise choices. In this webinar, you will gain the knowledge you need to reduce, or even eliminate, the risks facing your retirement from Social Security, Medicare, long-term care, and elder abuse.

FAQ

Questions everyone should ask about Social Security

The best time to enroll is when you are first eligible at age 65. Known as your Initial Enrollment Period (IEP), this is a 7-month span covering your birth month and the three months before and after that month.

During the Annual Enrollment Period (AEP) you may change your provider or plan to a better one. You may switch from Original Medicare to a Medicare Advantage plan, add or drop Part D.

Medicare does not cover long-term care facilities, dental care, eye exams, cosmetic surgery, international care, hearing aids, or holistic medicine.

Medicare Advantage plans may cover these services though but may be limited. Original Medicare does not offer prescription drug coverage. That is a standalone plan under Part D.

It thoroughly depends on your Medicare package and needs. Part A is premium-free. In 2022, Part B premiums are $170.10 before late penalties. With Part A and Part B you will also have deductibles. Your monthly amount may also vary if you have a Medigap plan and/or Part D. This applies, too, for Part C.

If you receive Social Security your Part B premiums will be deducted from your monthly payment. If you are not receiving SS benefits, you have two options. You may pay quarterly with a mail-in check or sign up for Medicare Easy Pay for monthly electronic payments.

It is important to account for the future when considering Part D for prescription drug coverage. While you might not be taking prescription drugs now you may need them later. Part D helps with lower out-of-pocket costs and copays.

Medicare Supplement plans work by covering out-out-pocket costs after Medicare pays their portion. Your medical providers will bill Medicare first and then your Supplement plan is billed for the remaining balance. It is also called Medigap because it fills the ‘gaps’ Original Medicare does not

Original Medicare and Medicare Advantage are the two routes. It fully depends on how much coverage you would like and what you need. Original Medicare is only Part A and B with the option to enroll in Part D for prescription coverage. Medicare Advantage, known as Part C, offers additional coverage through private insurance companies for vision, hearing, and dental that Original Medicare does not offer.

If you are enrolled in any part of Medicare, you may not contribute to a Health Savings Account

In some cases, you may delay your enrollment in Part B and Part D if you are still working and have health insurance. However, it is recommended that you enroll in Part A since it is premium-free and will make enrollment for the other Parts easier down the road. Unfortunately, you may not qualify for penalty-free delay and will be paying higher premiums when you do enroll

Still have questions? Submit them HERE and we will answer them!

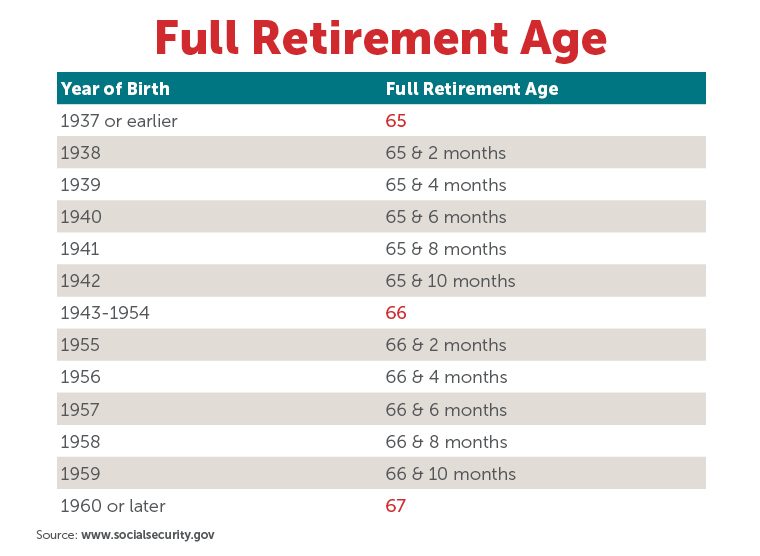

What is my full retirement age?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person’s situation is different.

Download our Social Security guide

Download our most comprehensive guide!

Additional Resources

For even more information, visit Socialsecurity.gov or connect with Social Security experts.