Speaking Overview

How to Eliminate the Financial Risks Threatening Your Retirement

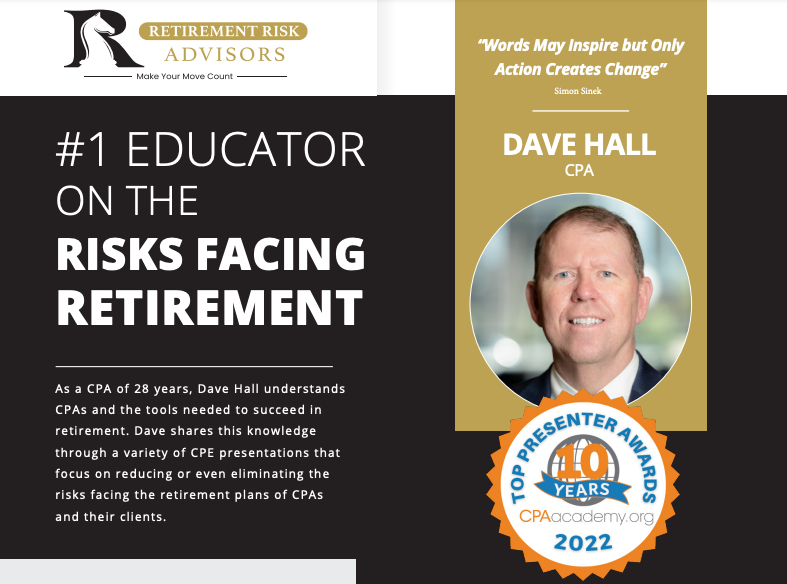

Dave Hall has been public speaking for over 30 years and has been dominating the podcast market. He knows how to entertain his audience and can bring the content down to any level.

He Is the Number One Educator in The Retirement Risk Space.

What will Dave speak about? He will address the financial risks threatening retirees and he will explain what can be done to eliminate these risks – even for those in their 60s & 70s. These risks include Social Security risk, tax rate risk, longevity risk, sequence of return risk, withdrawal rate risk, long-term care risk, inflation risk, elder abuse risk and income diversity risk. If you want Dave to speak at your next event, or online summit, click the button below to learn more and get in touch.

CURRENT PRESENTATIONS

We have 9 Presentations packed with great content

When it comes to retirement planning it is all about focus. But unfortunately, the focus for most people has been on how to get to retirement, rather than how they are going to get through their retirement. Retirement is going to be the longest, self-imposed, period of unemployment in your life, and you want to make sure you are ready to get through it. In this course, you will learn about 8 risks facing your retirement and how you can create a retirement plan to reduce, or eliminate these risks – even if you are in your 60’s or 70’s.

When it comes to retirement planning it is all about focus. But unfortunately, the focus for most people has been on how to get to retirement, rather than how they are going to get through their retirement. Retirement is going to be the longest, self-imposed, period of unemployment in your life, and you want to make sure you are ready to get through it. In this course, you will learn about 8 risks facing your retirement and how you can create a retirement plan to reduce, or eliminate these risks – even if you are in your 60’s or 70’s.

In this session, attendees will learn why a Life Insurance Retirement Plan (LIRP) is an important tool in getting to the 0% tax bracket in retirement. Attendees will learn about the things to look for in a good LIRP. Attendees will also learn why many of the myths about a LIRP are not true. You don’t have to love life insurance or even life insurance companies to listen to this webinar, you just have to like them a “little” more than you like the IRS.

In this session, attendees will learn why a Life Insurance Retirement Plan (LIRP) is an important tool in getting to the 0% tax bracket in retirement. Attendees will learn about the things to look for in a good LIRP. Attendees will also learn why many of the myths about a LIRP are not true. You don’t have to love life insurance or even life insurance companies to listen to this webinar, you just have to like them a “little” more than you like the IRS.

In this session, you will learn why longevity risk and tax rate risk are the two main things that will derail your retirement and what you can do to eliminate them both. Retirement money needs to last longer than at any time in our history and the only way to make it last is by reducing the risks associated with it. You don’t have to love annuities or even annuity companies to listen to this webinar, you just have to like them a “little” more than you like a retirement plan that is at risk of running out of money before you die.

In this session, you will learn why longevity risk and tax rate risk are the two main things that will derail your retirement and what you can do to eliminate them both. Retirement money needs to last longer than at any time in our history and the only way to make it last is by reducing the risks associated with it. You don’t have to love annuities or even annuity companies to listen to this webinar, you just have to like them a “little” more than you like a retirement plan that is at risk of running out of money before you die.

The average American spends more time planning their next vacation than they do planning their social security. In this webinar, you will learn why this is a big mistake. 97% of retirees will get some type of benefit from the social security program before they die, but most of them will leave tens of thousands of dollars on the table in the process. Why? Because they do not understand how the program works. In this webinar, you will learn what you need to know to maximize social security benefits for you and those you love, as well as those you may no longer love.

The average American spends more time planning their next vacation than they do planning their social security. In this webinar, you will learn why this is a big mistake. 97% of retirees will get some type of benefit from the social security program before they die, but most of them will leave tens of thousands of dollars on the table in the process. Why? Because they do not understand how the program works. In this webinar, you will learn what you need to know to maximize social security benefits for you and those you love, as well as those you may no longer love.

When it comes to retirement planning it is all about focus. But unfortunately, the focus for most people has been on how to get to retirement, rather than how they are going to get through their retirement. Retirement is going to be the longest, self-imposed, period of unemployment in your life, and you want to make sure you are ready to get through it. In this course, you will learn about 8 risks facing your retirement and how you can create a retirement plan to reduce, or eliminate these risks – even if you are in your 60’s or 70’s.

When it comes to retirement planning it is all about focus. But unfortunately, the focus for most people has been on how to get to retirement, rather than how they are going to get through their retirement. Retirement is going to be the longest, self-imposed, period of unemployment in your life, and you want to make sure you are ready to get through it. In this course, you will learn about 8 risks facing your retirement and how you can create a retirement plan to reduce, or eliminate these risks – even if you are in your 60’s or 70’s.

Getting to retirement is the easy part. Making sure you don’t run out of money before you run out of retirement is the hard part. In this course, you will learn a simple solution to eliminating two of the greatest risks facing your retirement, sequence of return, and withdrawal rate risk. If not addressed, sequence of return and withdrawal rate risk can derail your retirement assets up to 15 years sooner than if you eliminate them.

Getting to retirement is the easy part. Making sure you don’t run out of money before you run out of retirement is the hard part. In this course, you will learn a simple solution to eliminating two of the greatest risks facing your retirement, sequence of return, and withdrawal rate risk. If not addressed, sequence of return and withdrawal rate risk can derail your retirement assets up to 15 years sooner than if you eliminate them.

Medical costs are on the rise. It is estimated that the average couple will spend $285,000 in medical expenses during their retirement.

In this webinar, attendees will learn the information needed to better understand the Medicare program and the benefits to which they are entitled. Attendees will learn strategies to save thousands of dollars on medical costs during retirement. The webinar will also include a segment on disability and the basic rules of the program.

What is a Reverse Mortgage? Is it just a loan program designed for mortgage companies to steal your home during retirement, or is it a good option to get to a tax-free and risk-free retirement? In this webinar, I will cover the details of how a Reverse Mortgage works, and what you need to know to determine if a Reverse Mortgage can benefit you.

What is a Reverse Mortgage? Is it just a loan program designed for mortgage companies to steal your home during retirement, or is it a good option to get to a tax-free and risk-free retirement? In this webinar, I will cover the details of how a Reverse Mortgage works, and what you need to know to determine if a Reverse Mortgage can benefit you.